Debitum Investments receives “A level” taxpayer rating

In the good practice for businesses rating of the Latvian State Revenue Service (SRS), the owner of the Debitum Investments platform, “DN Operator” LTD has received the highest – A level rating.

The taxpayer rating is an assessment made by the SRS, based on the company’s fulfillment of tax obligations. It is informative in nature and makes it easier for its cooperation partners, customers, and other interested parties to find out about the company’s situation.

The rating was established at the end of 2023 and is applicable to all companies registered in Latvia.

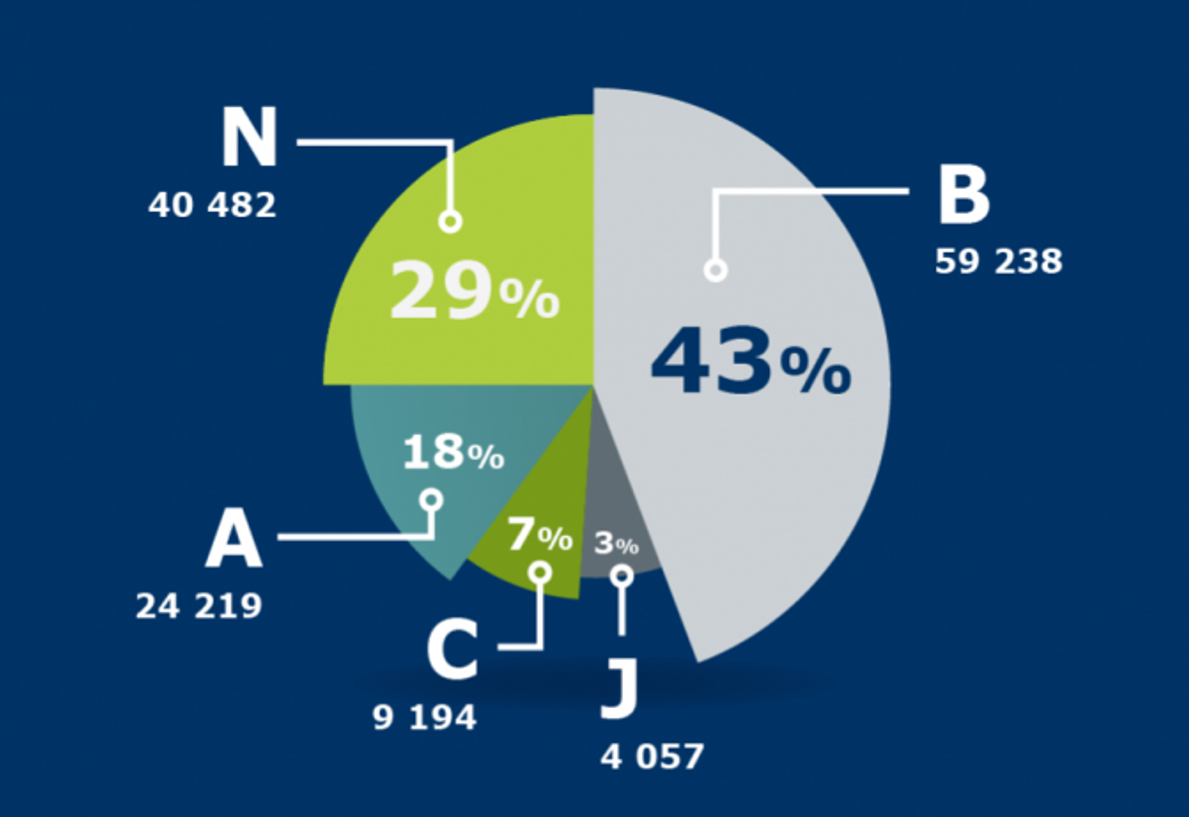

In the rating, companies are divided into 5 categories – A, B, C, N and J – where A is the highest level.

“We are pleased with the A-level assessment. This confirms the actual situation in Debitum Investments, and also shows the values and principles of the company’s management – to operate professionally, transparently and in good faith,” comments Debitum Investments co-owner, Ēriks Reņģītis.

As of December 31, 2023, 18% of all Latvian companies, are rated with A level.

Rating levels:

A – Good performance

B – Needs improvement

C – Violations exist

N – Inactive taxpayer

J – Newly-registered

When determining a company’s ranking, the six sets of indicators are applied:

- Registration data. SRS checks whether bankruptcy proceedings have not been initiated, whether economic activity has not been suspended, or whether the company has not been excluded from the VAT payer register. The rating is also influenced by company officials’ history of tax compliance.

- Timely submission of declarations and reports.

- Tax payments. For a good rating, it is important to pay taxes on time and in full, but if a debt arises, you can contact SRS (in time) and agree on payment of the debt in installments.

- Penalties. Anyone can make mistakes and fines occur, even for honest companies. However, it is important that the proportion of fines is small compared to total tax payments and that the size of the fine does not indicate a serious violation.

- Wage assessment. SRS compares the wage paid by the company with the average wage in the relevant industry and region as well as in the country. Unusually low wages indicate undeclared wage risks and can lower the rating.

- Information that may indicate violations. The rating may be reduced by risks revealed in SRS risk analyses.