What you should know about ABS and NOTES

Debitum Investments’ Comparison of ABS and NOTES

In late 2021, Debitum Investments (DN Operator LLC) was granted an Investment Service Provider license by the Bank of Latvia, marking a significant milestone. By February 2022, Debitum distinguished itself as the first peer-to-peer platform in Europe to offer investments in business loans, specifically Asset-Backed Securities (ABS). Since this initiative, 127 ABSs have been issued by five Loan Originators.

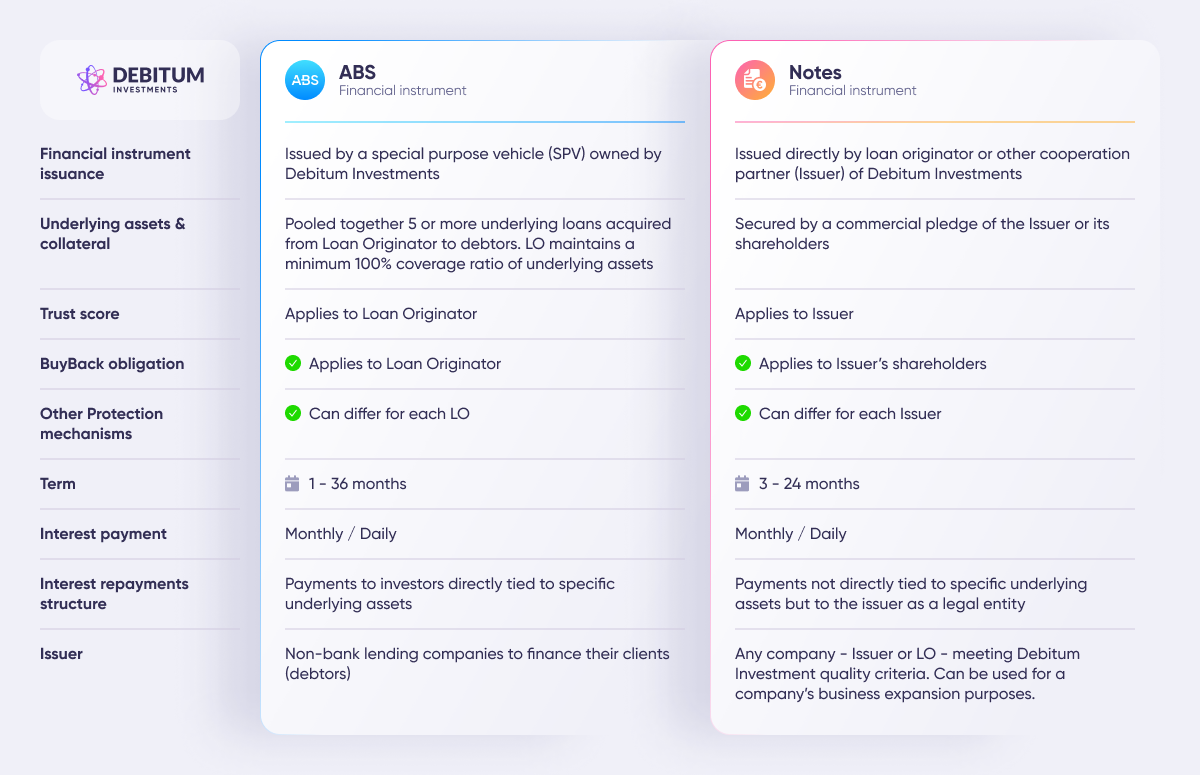

In March 2024, Debitum Investments introduced another financial instrument—Debitum Notes. To clarify differences between these two financial instruments, we have prepared a comparison table. This resource is designed to demystify the specifics and help investors make informed decisions.

The comparison chart outlines several key aspects of each instrument:

- Financial Instrument Issuance: Details how ABS are issued through a special purpose vehicle owned by Debitum Investments, while Notes are issued directly by loan originators or other cooperation partners.

- Underlying Assets & Collateral: Shows the backing for each type of instrument, whether it’s pooled loans for ABS or commercial pledges for Notes.

- BuyBack Obligation and Other Protection Mechanisms: Explains the security features applicable to both instruments and how they protect investors.

- Interest Payments and Terms: Describes the frequency of interest payments and the term lengths of the instruments.

- Purpose and Suitability: Details whom each instrument is best suited for and their primary uses within the investment landscape.

If you have further questions, please feel free to contact us at [email protected]. We’re here to help!